Valuation Insights - Why Northamptonshire?

October 13, 2022

Why Northamptonshire?

Northamptonshire is situated in the East Midlands at the heart of the UK with a population of 785,200 according to data from the 2021 Census. The recorded population in this area reflects an increase of 13.5% from the 2011 Census. Indeed, such is the growth of Northamptonshire as a whole, the county is among the top 25 areas for population growth.

Well connected

Northampton being situated some 40 miles south of the reported centre of England (Fenny Drayton), is a strategic location for many businesses due to its excellent road and rail links which are key economic drivers.

Important towns within the county include Northampton, Brackley, Towcester and Daventry. Northampton is served by Junctions 15, 15a and 16 of the M1 and nearby towns have close road links to the A5, M40 and A45.

Kettering and Corby in East Northamptonshire have seen large-scale development and growth as a lower cost alternative to Northampton and its immediate surrounds.

Notable commercial developments include the long-established Moulton Park, Round Spinney and Brackmills, and the more recent developments of Daventry International Rail Freight Terminal (DIRFT), Grange Park, Swan Valley, Pineham and Panattoni Park along the M1 corridor.

In addition, construction of SEGRO’s Logistics Park Northampton (SLPN), strategically located a few miles to the south at Junction 15 of the M1 is well underway.

Property by numbers

According to research by Costar Group, Industrial property in Northamptonshire accounts for 75% of the county’s £16.3 billion of commercial assets (office, retail and industrial). Across all commercial property sectors, 96 sales have taken place over the course of 2022 with a value of £1.1 billion. To demonstrate the strength of the industrial market, 52 of these sales involved premises in the industrial sector.

The total value of industrial stock has risen from £11.6 billion to £12.2 billion over the course of 2022. Whilst some of this growth in value can be accounted for by the delivery of new stock, this in part due to a sharpening of investment yields over 2021.

Although fewer industrial properties have transacted so far this year, at a total of £990 million, the volume of sales has already outstripped the £880 million of industrial property that transacted in 2021 and is well ahead of the 10-year average of £359 million.

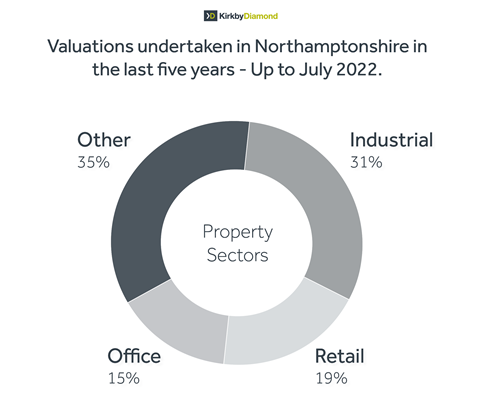

Valuations undertaken by Kirkby Diamond in Northamptonshire in the last 5 years by property sector.

31% Industrial | 19% Retail | 15% Office | 35% Other

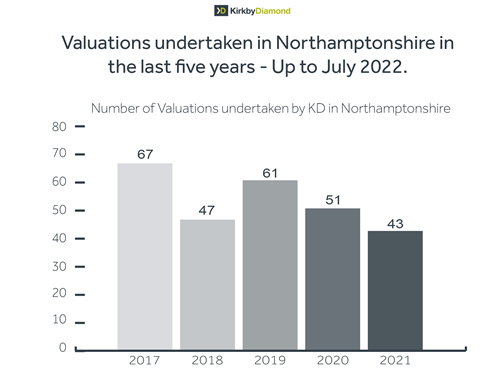

The number of valuations undertaken by Kirkby Diamond in Northamptonshire in the last 5 years.

2017 - 67 | 2018 - 47 | 2019 - 61 | 2020 - 51 | 2021 - 43

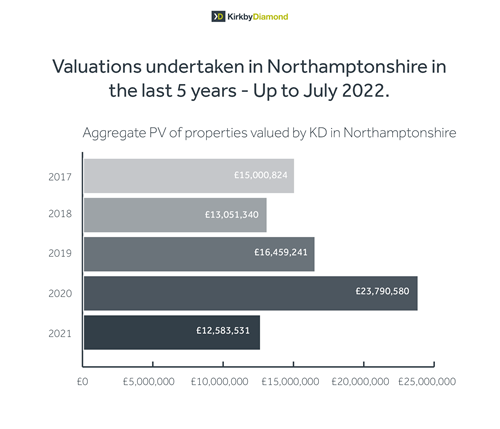

Aggregate PV (Property Value) of properties valued by Kirkby Diamond in Northamptonshire in the last 5 years.

2017 - £15,000,824 | 2018 - £13,051,340 | 2019 - £16,459,241 | 2020 - £23,790,850 | 2021 - £12,583,531

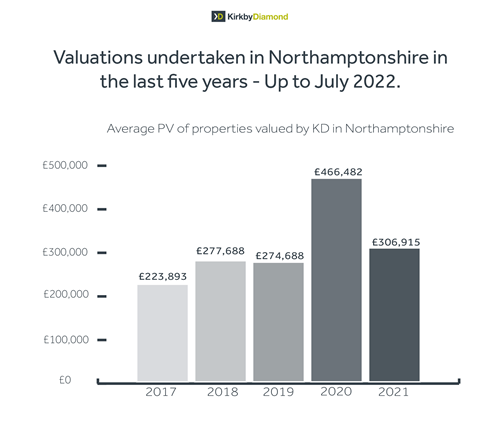

Average PV (Property Value) of properties valued by Kirkby Diamond in Northamptonshire in the last 5 years.

2017 - £223,893 | 2018 - £277,688 | 2019 - £274,688 | 2020 - £466,482 | 2021 - £306,915

Future Development

DIRFT: The Daventry International Rail Freight Terminal (DIRFT), situated west of Junction 18 of the M1, is set to expand with planning consent granted for a further 1,000,000 sq ft of distribution warehouse space.

In addition, construction of SEGRO’s Logistics Park Northampton (SLPN), strategically located a few miles to the south at Junction 15 of the M1 is well underway and this will provide the county with a further rail freight interchange and over 5 million sq ft of new distribution space.

Darren Pape comments “Being Northamptonshire born and bred, I have seen significant changes in the make up of the county. The level of industrial development over the last 20 years is of no surprise due to the county’s location. As values have risen further down the M1, Northampton was once seen as a secondary location to other locations including Hemel Hempstead and Milton Keynes. With a rise in the logistics sector, Northampton is now perfectly placed to cater to the mid- to big-box market. There remains a healthy appetite for smaller commercial space from SME businesses and development of business units below 10,000 sq ft would be well received by those in the market".